oklahoma inheritance tax rate

The top marginal individual income tax rate was permanently increased from 49 to 59 with the addition of a new bracket. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax.

We would like to show you a description here but the site wont allow us.

. Distilled spirits which have an alcoholic content of at least 40 are taxed at a rate of 250 per gallon. The cigarette tax is a relatively low 115 per pack. Vapor Taxes by State 2022.

4 prescriptions and food for home consumption are exempt. Twelve states and Washington DC. North Dakota Known form long roads.

In April 2021 New Yorks highest tax rate changed with the passage of the 20212022 budget. A county lodging tax varies from 2 to 4 and is added to. For further information visit the Oklahoma Tax Commission site or call 405 521-3160.

Beer is taxed at a rate of 024 per gallon and wine is taxed at a rate of 075 per gallon. State Income Tax Range. Inheritance and Estate Tax and Inheritance and Estate Tax Exemption.

John left his best friend a home valued at 500000 and Johns state also collects an inheritance tax of 15 from nonrelatives. 694 Median Property Tax Rate. Impose estate taxes and six impose inheritance taxes.

Average Combined State and Local Sales Tax Rate. 1561 per 100000 of assessed home value Estate Tax or Inheritance Tax. There is no inheritance or estate tax in Oklahoma.

Oklahoma Becomes First State in Nation to Make Full Expensing Permanent. 71 million Estate tax rates. No Inheritance tax rates.

The sales tax and real estate taxes are average but the state has some of the lowest auto taxes in our comparison. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as. His friend who isnt related to him is liable for the inheritance tax on this amount.

Tax Foundation is Americas leading independent tax policy resource providing trusted nonpartisan tax data research and analysis since 1937. Learn Oklahoma tax rates for income property sales tax and more to estimate how much you will pay in 2022. The alcohol tax varies depending on the variety and alcoholic content of the beverage.

Maryland is the only state to impose both. Yes Estate tax exemption level. Home to the beautiful Badlands National Park South Dakota comes in fourth place with an effective state tax rate of 639.

108 - 12 Inheritance tax. The previous 882 rate was increased to three graduated rates of 965 103 and 109. Oklahoma state income tax rates range up to 5.

Counties can add up to 2 in additional taxes. There is no state income tax and the average sales tax is 832.

Indianola Oklahoma Ok 74442 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Best State Capitals To Live In 2022 Report Fox Business

Altered State A Checklist For Change In New York State Empire Center For Public Policy

Indianola Oklahoma Ok 74442 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Oklahoma Probate Handbook 2022 Ed Vo Legal Solutions

Sustainability Free Full Text Current Situation And Sustainable Renewal Strategies Of Public Space In Chinese Old Communities Html

Oklahoma On Pro Growth Property Tax Reform Ke Andrews

Indianola Oklahoma Ok 74442 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Is Probate Necessary When A Spouse Dies In Oklahoma Oklahoma Estate Planning Attorneys

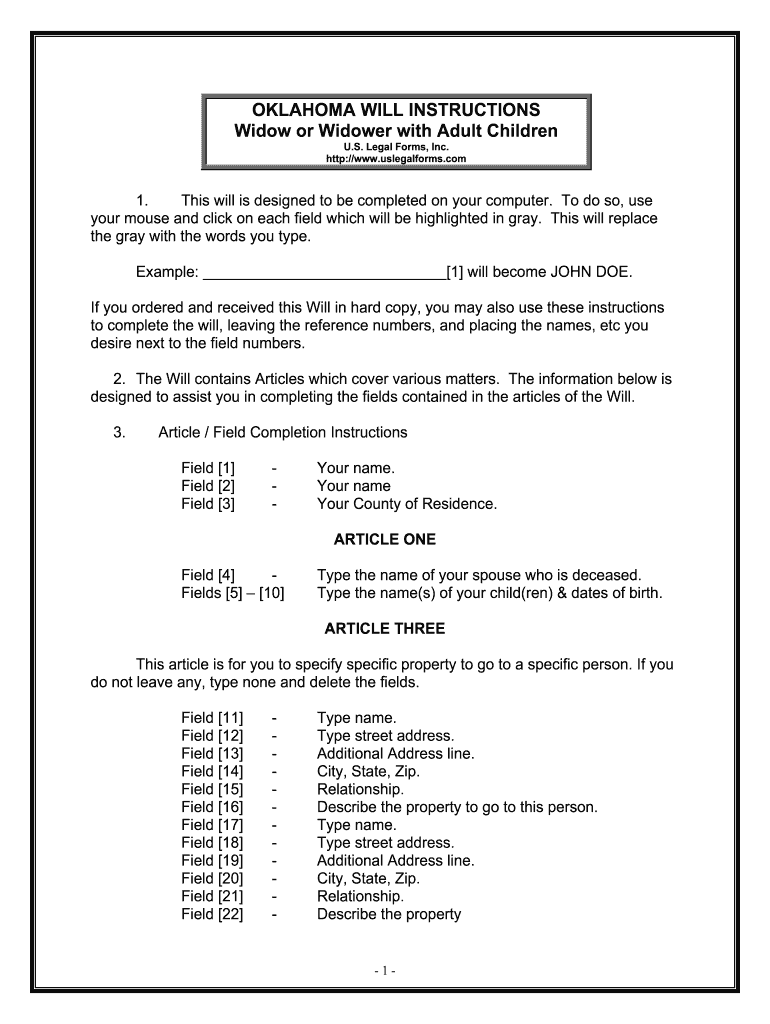

Oklahoma Will Instructions Will Samples And Guides Signnow

Jordan On Twitter Oklahoma S Schools Are Some Of The Lowest Funded In The Country Teachers Have Been Sharing Pictures Of Inadequate School Supplies Showing The Horrible Condition Textbooks Are In Https T Co Mrc0e2fzvm Twitter

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Inheritance

Tax Trusts Estate Planning Employee Benefits Erisa Oklahoma